|

Nasdaq 1002 | S&P 5002 | |

|---|---|---|---|

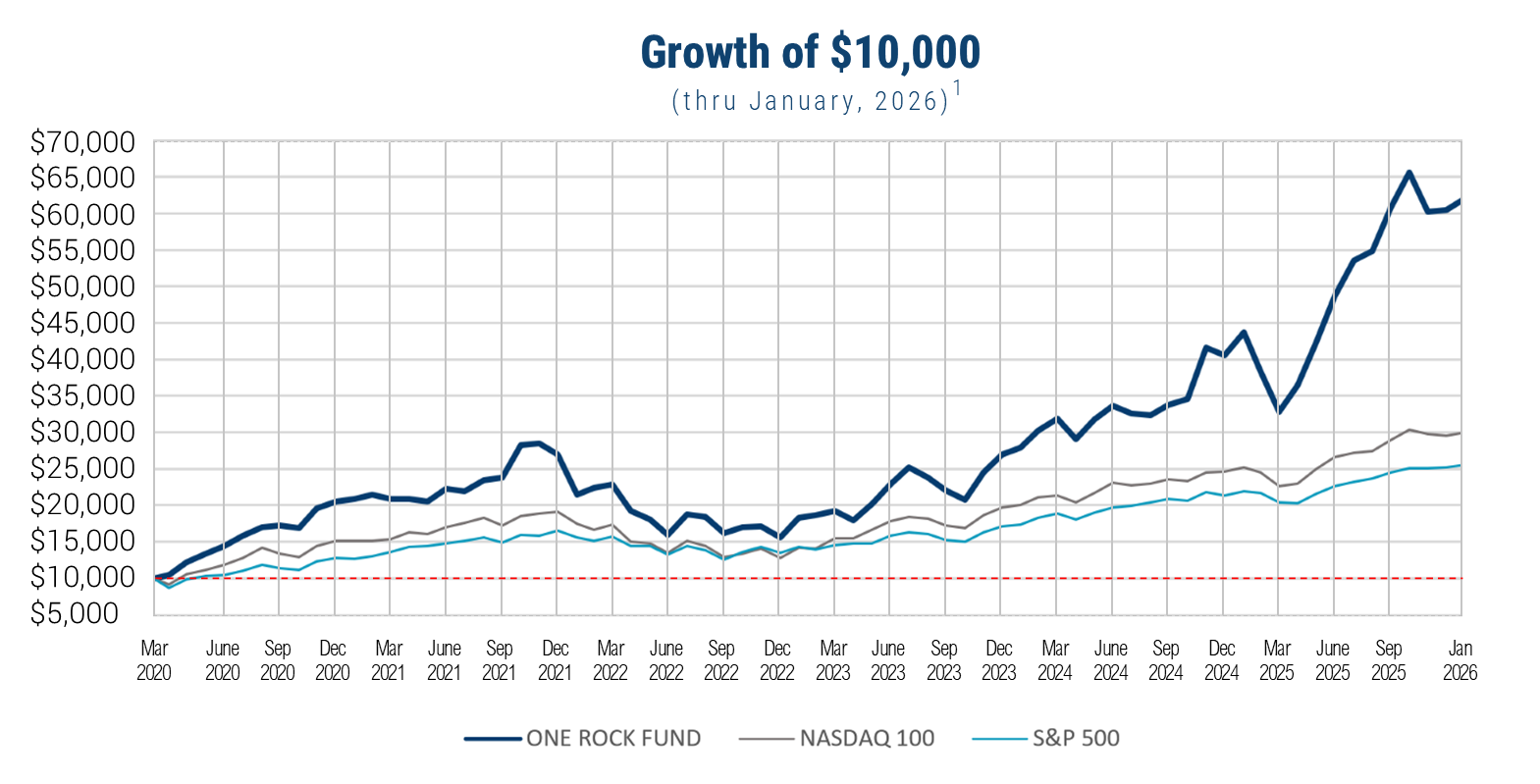

| March 20201 | 5.00% | -8.40% | -12.92% |

| 2Q 2020 | 36.95% | 29.99% | 20.54% |

| 3Q 2020 | 20.34% | 12.42% | 8.93% |

| 4Q 2020 | 18.42% | 12.88% | 12.15% |

| 20201 | 104.93% | 51.09% | 28.24% |

| 1Q 2021 | 1.87% | 1.58% | 6.17% |

| 2Q 2021 | 6.76% | 11.18% | 8.55% |

| 3Q 2021 | 6.62% | 0.92% | 0.58% |

| 4Q 2021 | 13.41% | 11.10% | 11.03% |

| 2021 | 31.52% | 26.63% | 28.71% |

| 1Q 2022 | -15.14% | -9.08% | -4.60% |

| 2Q 2022 | -30.10% | -22.47% | -16.10% |

| 3Q 2022 | 1.32% | -4.63% | -4.88% |

| 4Q 2022 | -3.56% | -0.29% | 7.56% |

| 2022 | -42.04% | -32.97% | -18.11% |

| 1Q 2023 | 22.93% | 20.49% | 7.50% |

| 2Q 2023 | 19.05% | 15.16% | 8.74% |

| 3Q 2023 | -3.83% | -3.06% | -3.27% |

| 4Q 2023 | 22.50% | 14.34% | 11.69% |

| 2023 | 72.41% | 53.81% | 26.29% |

| 1Q 2024 | 18.54% | 8.49% | 10.56% |

| 2Q 2024 | 5.42% | 7.82% | 4.28% |

| 3Q 2024 | 0.30% | 1.92% | 5.89% |

| 4Q 2024 | 20.02% | 4.74% | 2.41% |

| 2024 | 50.42% | 24.88% | 25.02% |

| 1Q 2025 | -19.03% | -8.25% | -4.27% |

| 2Q 2025 | 48.38% | 17.64% | 10.94% |

| 3Q 2025 | 25.03% | 8.82% | 8.12% |

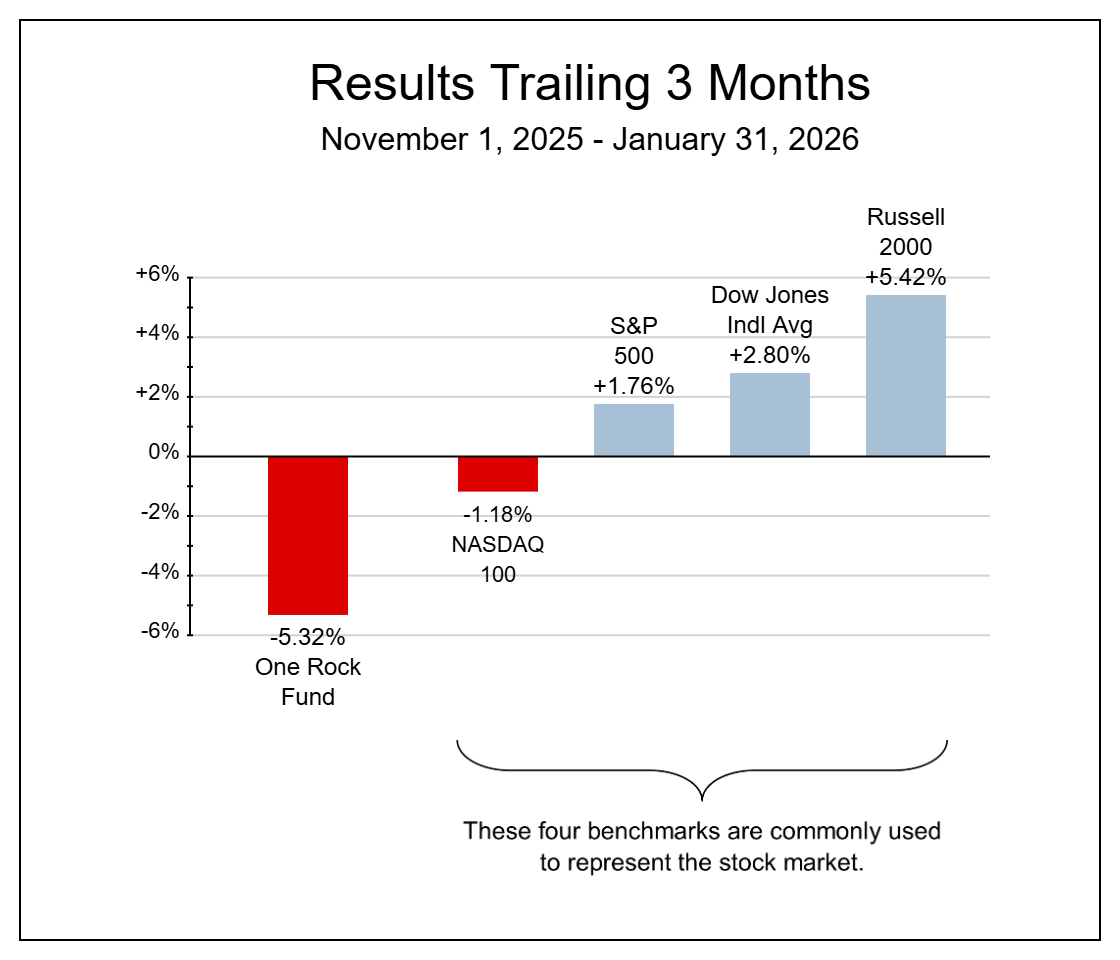

| 4Q 2025 | -0.62% | 2.31% | 2.65% |

| 2025 | 49.28% | 20.17% | 17.88% |

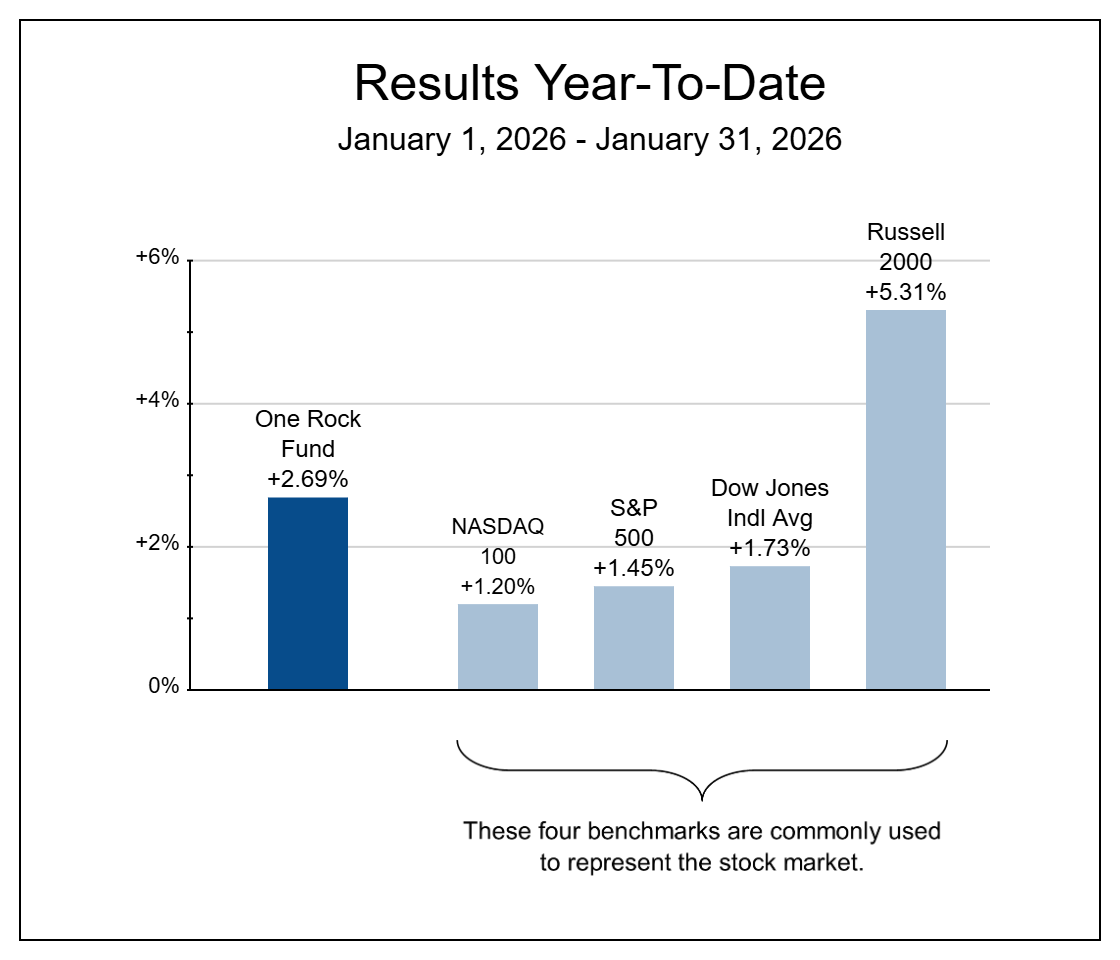

| January 2026 | 2.69% | 1.20% | 1.45% |

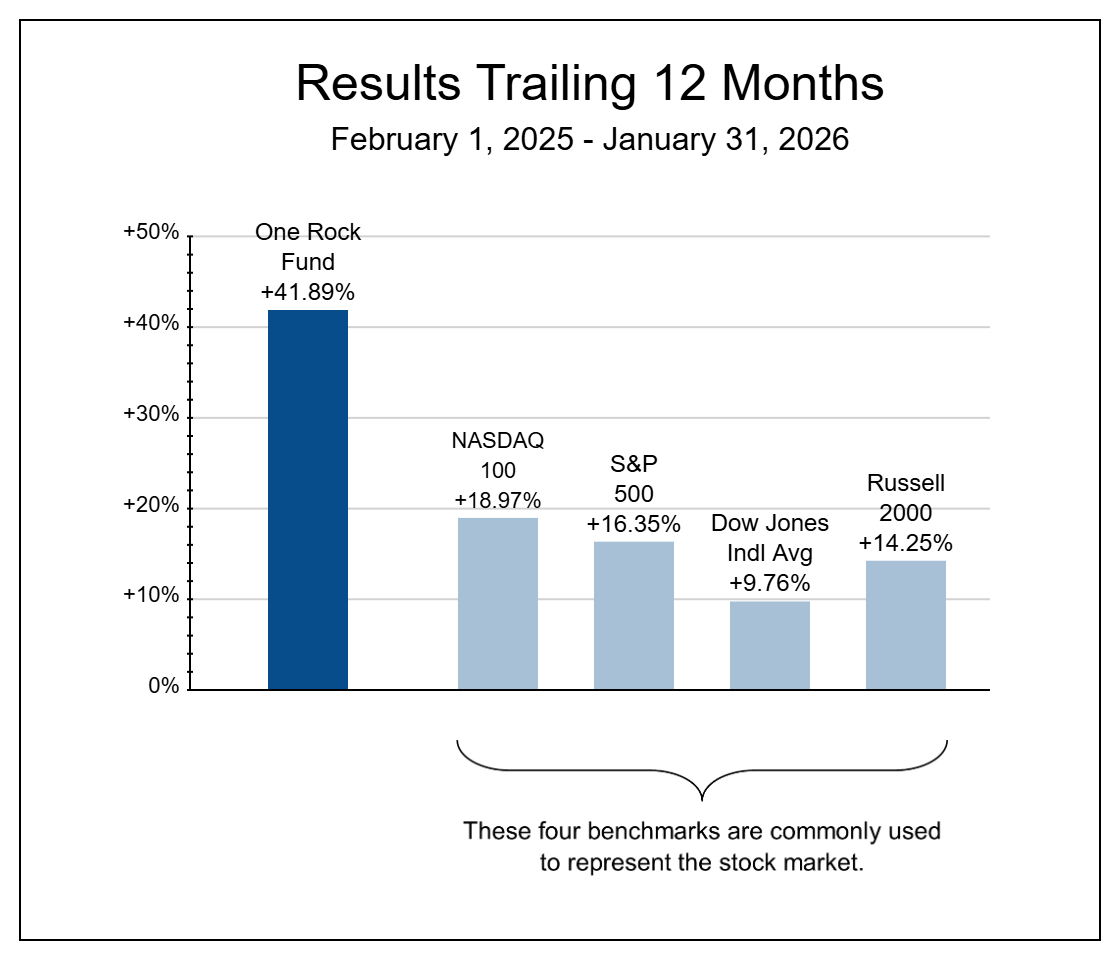

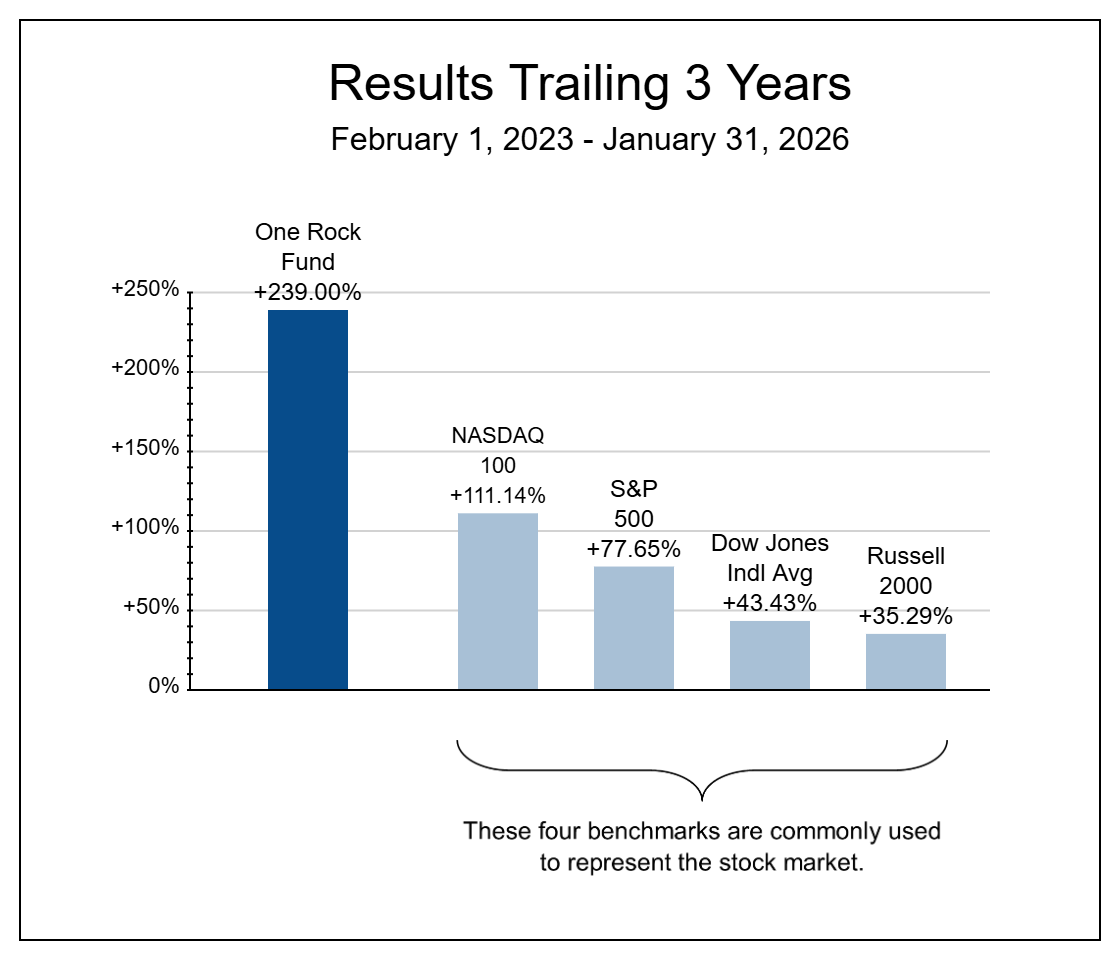

| Last 3 Years Annualized |

239.00% 50.22% |

111.14% 28.29% |

77.65% 21.11% |

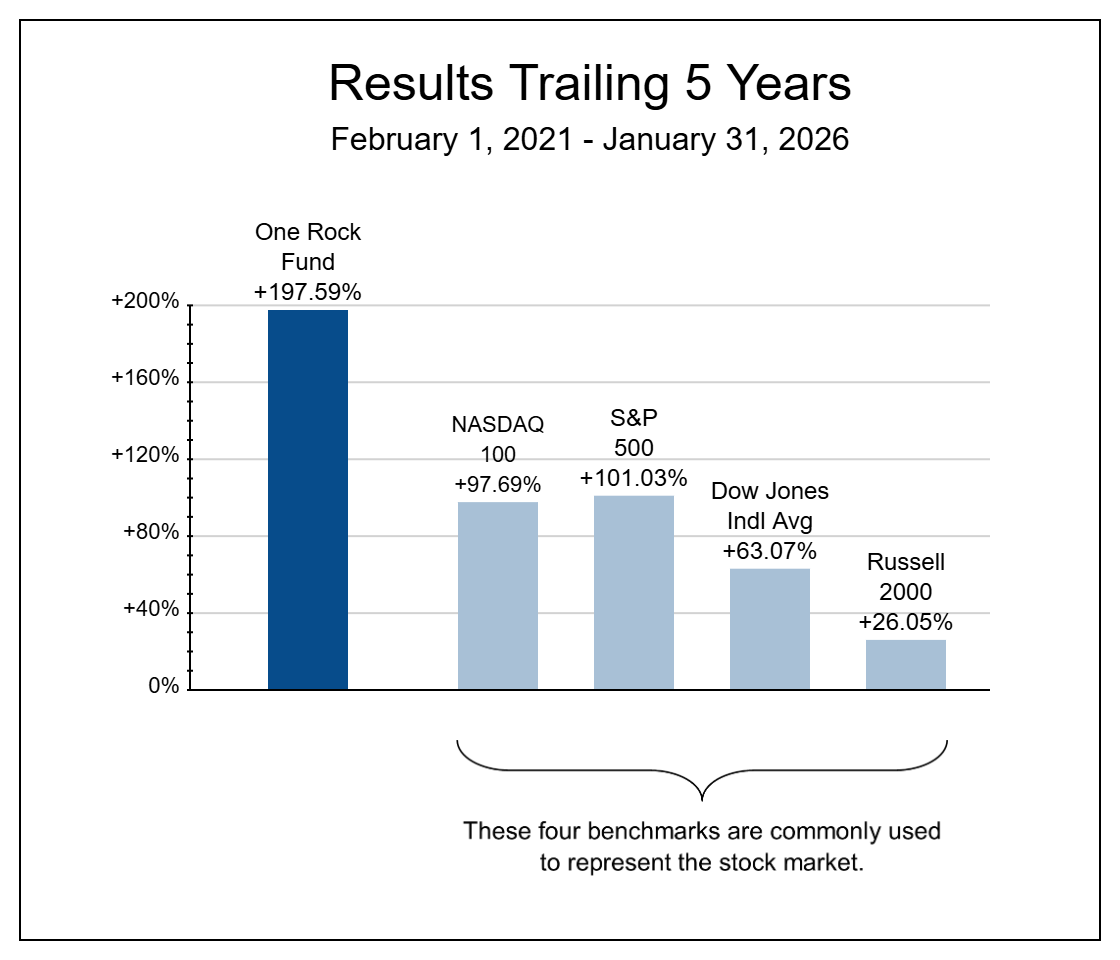

| Last 5 Years Annualized |

197.59% 24.37% |

97.69% 14.60% |

101.03% 14.99% |

| Since Inception Annualized |

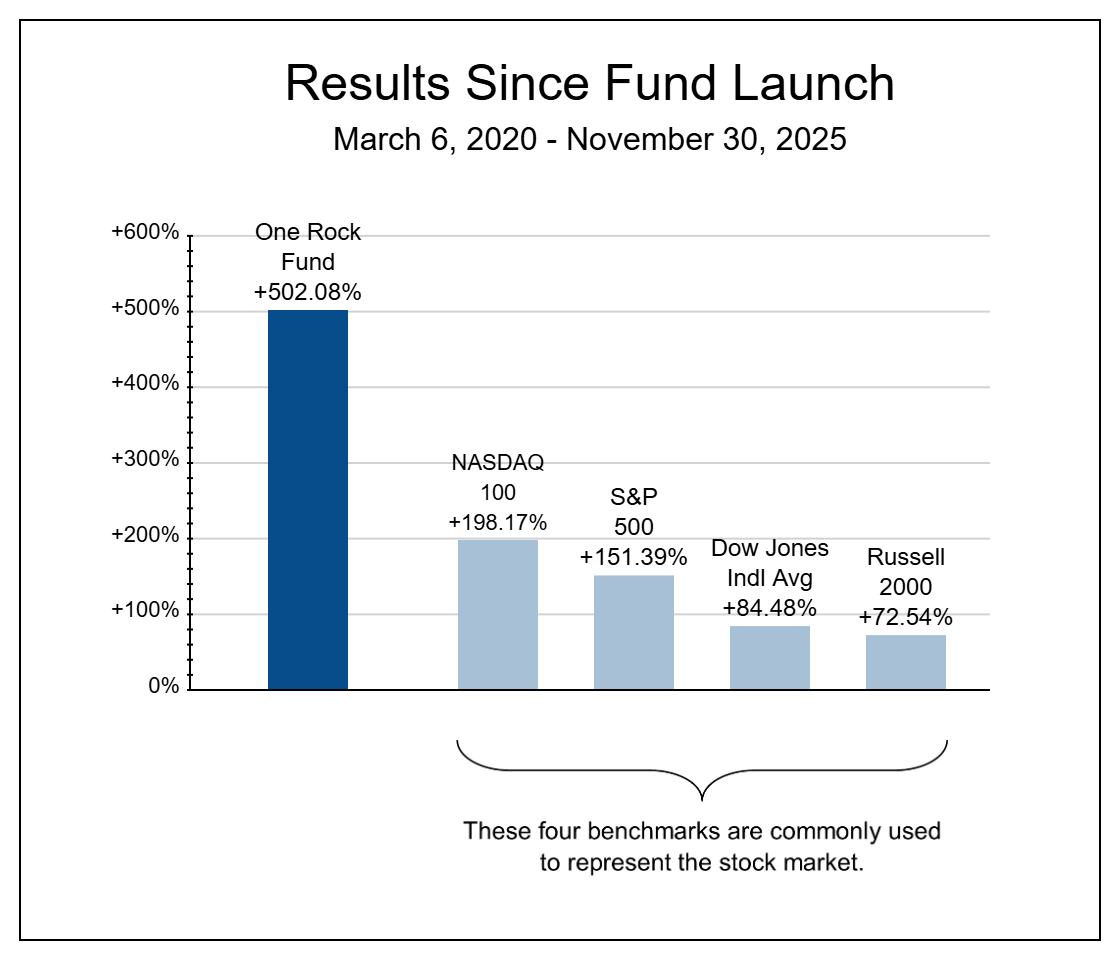

521.09% 36.25% |

199.55% 20.42% |

155.19% 17.19% |